- Ethereum holds steady at around $3,000, with rising funding rates suggesting a potential bullish rebound.

- Major moves from figures like Justin Sun and Whales indicate growing confidence in a price rally.

- With increased buying activity, ETH could target the $4,000 resistance level soon.

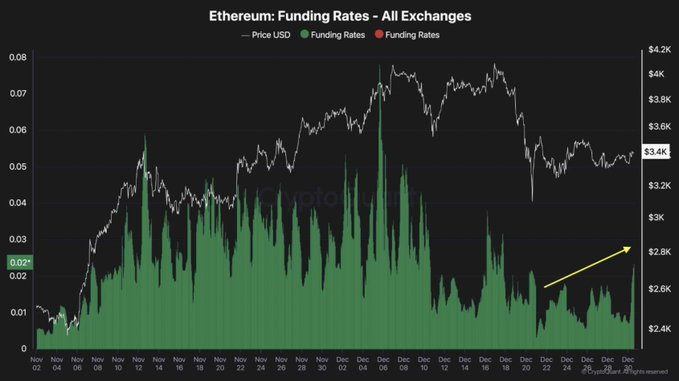

Ethereum’s recent price movement has captured the attention of traders and investors as it recovers from a significant correction, holding steady around the $3,000 level. The cooling-off period in the futures market has sparked renewed expectations for a potential bullish rebound. In this scenario, the key indicator to watch is Ethereum’s funding rates, a crucial metric for gauging market sentiment, showing signs of optimism.

Following ETH’s dip to the critical $3,000 support level, the price has consolidated, providing a solid foundation for bullish participants to re-enter the market. This stability has reignited confidence, with more traders opening long positions, reflected in a sharp uptick in funding rates. As the futures market sentiment improves, this surge in demand signals that the broader market is anticipating a possible reversal of the recent downtrend.

The increase in funding rates, a signal of rising buyer activity, indicates a potential bullish rally. If this momentum continues, Ethereum could be on track to challenge the crucial $4,000 resistance level in the short to medium term. With the market showing signs of positive sentiment, traders are watching closely for any indication that ETH is preparing for another leg up in its price action.

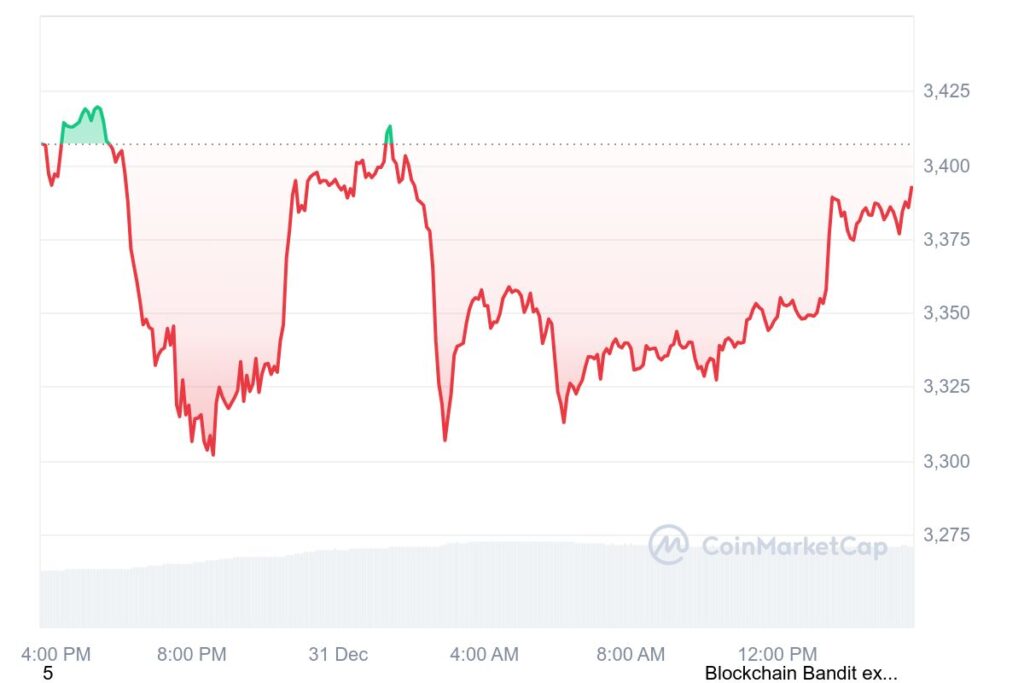

At the time of writing, ETH is priced at $3,394.40, with a 24-hour trading volume of $26.27 billion and a market capitalization of $408.89 billion. While the cryptocurrency has experienced a minor decline of 0.67% over the last 24 hours, the broader market remains hopeful for a recovery.

Ethereum Poised for Rally as Sun and Whales Make Major Moves

Adding to the bullish narrative is the activity of prominent figures in the crypto space. Justin Sun, the founder of Tron and a well-known crypto entrepreneur, has recently made substantial moves. According to data from Lookonchain, Sun deposited 29,153 ETH (worth $96.7 million) and 249,868 EIGEN (valued at $884,000) to HTX, a crypto exchange, 11 hours ago.

This follows a significant accumulation of Ethereum, with Sun having deposited a total of 227,000 ETH (approximately $807 million) to HTX since November 10. Much of this Ethereum was acquired at around $3,036 during the first half of 2024.

Furthermore, Sun has also requested the unstaking of 96,580 ETH (worth $322.7 million) from Lido Finance and Etherfi, likely in preparation for further deposits to HTX. These strategic moves by high-profile investors further suggest a bullish outlook for Ethereum, reinforcing the idea that large players are positioning themselves for a potential price rally.

In addition to Sun’s activity, another whale has recently made a significant purchase. According to Lookonchain, this whale bought 22,919 ETH (valued at $77.2 million) at an average price of $3,368 just four hours ago.

Since August 12, this whale has completed 25 swing trades in Ethereum and Bitcoin, with 21 of them being profitable, resulting in a total profit of $4.57 million. Such activity from large investors underscores growing confidence in Ethereum’s market performance and the potential for a rebound.

However, all eyes are on Ethereum’s ability to maintain its momentum and push toward the $4,000 mark. If the funding rates and investor activity continue to support the current trend, Ethereum could be setting up for a significant bullish phase in the coming weeks.

Related | MicroStrategy’s Bitcoin Holdings Surge to 192,042 BTC Amid Market Speculation