- Jump Trading, a key player in the crypto market, has offloaded a total of 120,695 wstETH tokens

- The significant wstETH liquidation coincides with Ethereum’s price dropping by over 33% during a similar period, raising investor concerns about market stability.

- Jump Trading is under investigation by the U.S. Commodity Futures Trading Commission (CFTC)

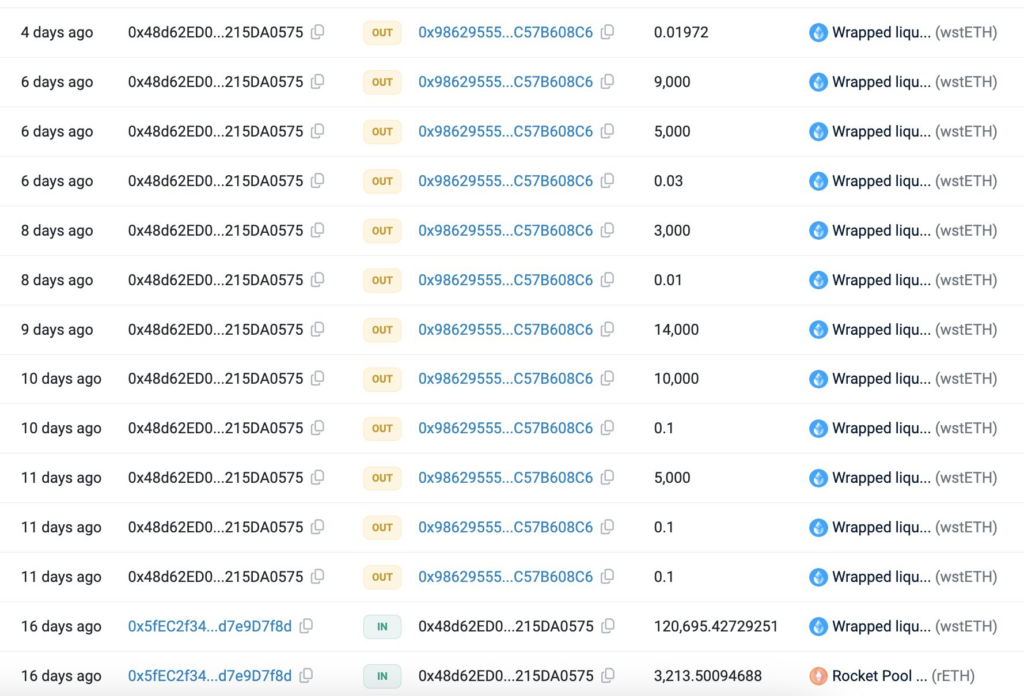

Ethereum, the leading cryptocurrency, has been caught in a whirlwind of market downturns after significant moves by major market players. Jump Trading., a prominent crypto market maker, has offloaded a total of 120,695 wstETH (wrapped staked Ethereum) tokens worth roughly $481 million. This transaction coincides with the sale of another 83,000 wstETH valued at nearly $377 million since July 24th, bringing the total sold-off assets to $585 million and leaving them with just 37,604 wstETH ($104 million).

Notably, the massive sell-off aligned with ETH plummeting by more than 33% in a similar timeframe, raising concerns among investors. Jump trading is at the center of a major controversy after news emerged that the US Commodity Futures Trading Commission (CFTC) is investigating the crypto market maker due to its alleged connections to the LUNA collapse. The founders of Jump Trading are former CME Group pit traders, and they have been instrumental in driving growth across multiple ecosystems.

Jump Trading has also worked in many other critical infrastructures and projects, especially the Wormhole Bridge. However, they also faced scrutiny over allegations of price manipulation of LUNA just before its collapse. According to market experts, these past controversies could intensify the ongoing CFTC investigation. The latest wave of liquidation of significant portions of its portfolio could be part of a potential settlement with the regulatory body.

Jump Trading’s Ethereum Exodus Due to CFTC Probe?

While authorities remain tight-lipped on the investigation details, the crypto community speculates on Jump’s Trading next move. Some reports suggest that the firm is exiting the crypto market maker business and is strategically shifting its wstETH holdings. This would be a significant development, as Jump has been a major player in the Ethereum ecosystem for many years. Another possibility is Jump sold 120,695 wstETH in a bid to recover funds from the infamous Wormhole Exploit.

Irrespective of the reasons, Jump Trading’s actions will set off an explosion through the Ethereum market. It is important to note that Jump Trading has not yet officially confirmed the sale and the CFTC investigation. As the story unfolds, we can expect further clarity and its impact on the Ethereum market. Investors are closely monitoring the situation, and the coming days could be crucial in determining the direction of Ethereum’s price.