- Gemini will close Canadian accounts by December 31, 2024, giving users 90 days to withdraw assets due to new regulations.

- Other exchanges, including OKX and Binance, are also leaving Canada amid stricter rules from the Canadian Securities Administrators (CSA).

- The CSA’s new rules require enhanced investor protections and compliance for crypto platforms.

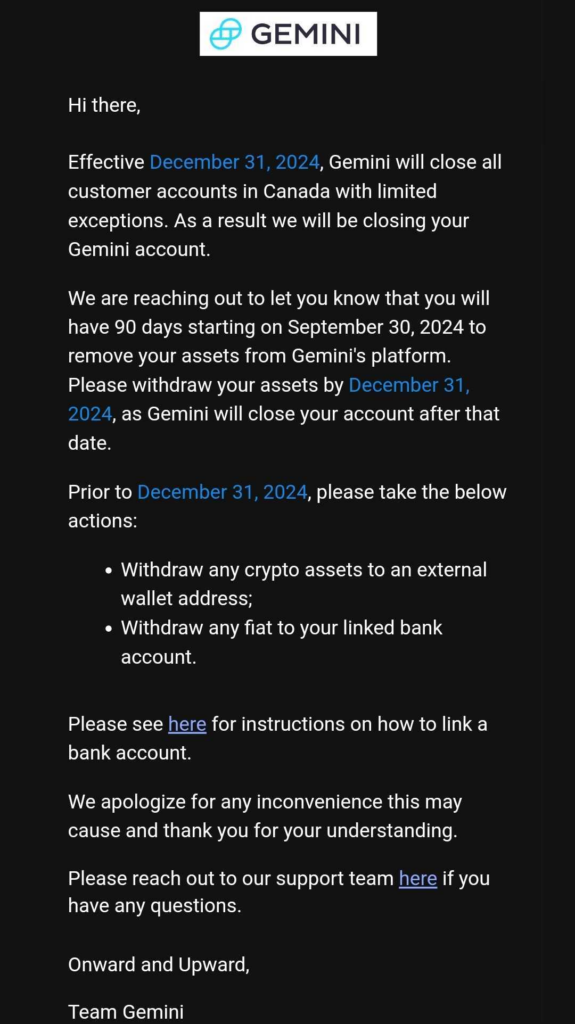

Cryptocurrency exchange Gemini announced that it will close all Canadian accounts by December 31, 2024, affecting most users. In an email, the platform advised users they have 90 days to withdraw their assets, highlighting that this decision comes in light of newly imposed Canadian regulations on cryptocurrency exchanges. Users are instructed to transfer their digital currencies to external wallets or cash out fiat to their linked bank accounts before the deadline.

Gemini Joins Other Exchanges Exiting Canada

This move aligns with a broader trend as other exchanges, including OKX, dYdX, Paxos, Bybit, and Binance, have also exited the Canadian market recently, prompting speculation about the implications of the new regulatory environment.

The Canadian Securities Administrators (CSA) introduced a Pre-Registration Undertaking (PRU) in February, compelling all crypto asset trading platforms operating in Canada to commit to investor protection measures before they can continue functioning.

Gemini’s email outlined the necessary steps for Canadian users to withdraw their assets and expressed regret for any inconvenience caused. The CSA’s regulations focus on ensuring that cryptocurrency platforms offer the same level of safeguards as registered entities, reflecting heightened concerns over investor security following high-profile insolvencies like Voyager Digital, Celsius Network, and FTX.

These incidents have catalyzed the CSA’s efforts to reinforce regulatory frameworks surrounding digital assets, emphasizing the importance of safeguarding client assets, managing risks associated with trading, and maintaining operational integrity.

Under the new rules, exchanges must appoint a qualified Chief Compliance Officer and secure CSA approval before introducing certain products, particularly stablecoins. The CSA is intensifying its scrutiny of stablecoins and Value-Referenced Crypto Assets (VRCAs), which might be classified as securities.

Platforms that fail to comply with these new requirements face severe penalties, including potential removal from the market, highlighting the CSA’s commitment to ensuring a more secure trading environment for Canadian cryptocurrency investors.

As the regulatory landscape evolves, Gemini’s decision underscores the significant challenges faced by crypto exchanges in Canada. The CSA’s ongoing oversight reflects a determination to cultivate a safer ecosystem for investors, yet the shifting dynamics raise questions about the future of cryptocurrency trading in the region.

Related | Matrixport Completes Acquisition of Crypto Finance, Expands European Reach