- Japan’s Democratic Party for the People (DPP) leader proposes a 20% tax on crypto gains if elected.

- Japan’s Financial Services Agency (FSA) reviews cryptocurrency rules, which may lead to regulatory changes.

- Major companies like Sony and Mitsubishi UFJ are exploring blockchain and stablecoins amid calls for relaxed regulations.

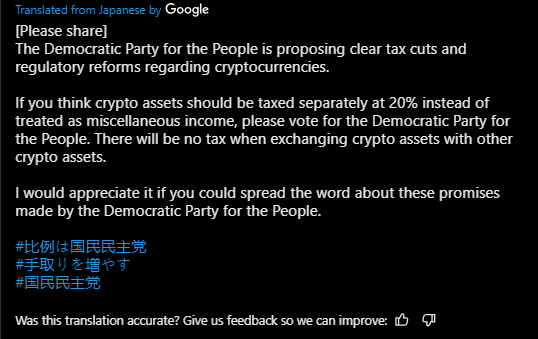

Yuichiro Tamaki, leader of Japan’s Democratic Party for the People (DPP), has proposed a significant tax cut for digital currency gains. If elected, Tamaki promises to reduce the tax on crypto profits to 20%, making digital assets more aligned with stock investments.

In an X post, Tamaki urged voters to support the DPP if they believe digital assets should be taxed separately at 20% rather than treated as miscellaneous income under Japan’s current laws.

In addition to lowering the tax rate, Tamaki’s plan includes eliminating taxes when exchanging one digital currency for another, a move that could simplify trading for investors.

He called on supporters to spread the word about these proposed changes, highlighting the DPP’s commitment to making crypto investments more attractive in Japan.

FSA to Review Crypto Regulations

In September, Japan’s Financial Services Agency (FSA) announced its intention to review the nation’s digital currency regulations. The review, set to take place over the coming months, could reassess how digital assets are classified.

Currently, crypto is regulated under the Payments Act, but officials are questioning whether this framework is sufficient for investor protection, given that tokens are primarily used for investing, not payments.

A potential reclassification of digital currencies under the Financial Instruments and Exchange Act could bring stricter regulations but also open the door for reduced taxes on crypto gains, aligning them with stocks at a 20% levy. However, as this is going to happen now, when Tamaki announced its intention.

Such a change in position may also open the door to new financial products tied to digital currencies, such as ETFs, which currently face restrictions within Japan.

Still, Japan’s crypto industry has yet to shake off tight regulation after major scandals such as the hacking of Mt. Gox in 2014. Still, several companies conduct research on blockchain-related studies. For instance, Sony Group and Mitsubishi UFJ Financial Group are studying possible uses for stablecoins and issuing digital tokens.

While this is the current review by the FSA, along with the proposed tax reforms by Tamaki, this could turn the tables in the crypto industry in Japan, which might make the market more accessible for investors and more appealing for businesses.

Related Reading | Solana’s Bullish Pennant Signals Potential Surge to $260