- Litecoin solidifies its position by integrating with Spain’s banking titan BBVA.

- Crypto analysts predict a significant price surge for Litecoin as Bitcoin approaches the $100,000 mark.

- Litecoin’s trading volume explodes, surpassing its market cap, as investors flock to the OG cryptocurrency.

Litecoin, often referred to as the silver to Bitcoin’s gold, is rapidly expanding its reach into the traditional finance sector. The leading altcoin, renowned for its faster transaction speeds and lower fees compared to bigger rival BTC, has integrated into banking services. The announcement was made at the recently held Litecoin Summit in Nashville, where the groundbreaking collaboration with Spanish banking giant BBVA was unveiled.

The partnership will now offer its Turkish customers the option to purchase LTC directly through its mobile app. This is a pivotal moment for Litecoin, bridging the gap between the digital and traditional financial worlds.

Banco Bilbao Vizcaya Argentaria, S.A., better known by its initialism BBVA, is a Spanish multinational financial services company based in Madrid and Bilbao, Spain. It is one of the largest financial institutions in the world and is present mainly in Spain, Portugal, Mexico, South America, Turkey, Italy, and Romania.

While this initial integration is currently limited to Turkey, it signifies a broader strategic move by Litecoin to position itself as a viable asset within the mainstream banking ecosystem. The partnership with BBVA could potentially pave the way for similar collaborations with other financial institutions globally.

As the digital asset market continues to evolve, Litecoin’s foray into banking services is a testament to its adaptability and potential to cater to a wider audience.

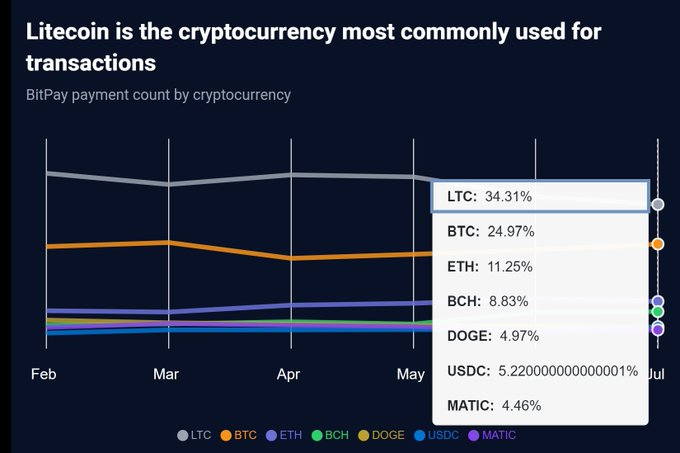

Litecoin is The Most Used Crypto

Continuing its impressive strides, the latest stats from BitPay for July show, that LTC has once again become the most commonly used cryptocurrency for transactions.

Adding to the momentum is crypto analysts are bullish on the leading altcoin, predicting a potential surge after Bitcoin hits the $100,000 mark. Despite facing a prolonged downtrend since 2014, LTC has been forming a classic falling wedge pattern, a bullish technical indicator. Many investors believe that Litecoin’s role as a faster, cheaper alternative to Bitcoin could position it for significant growth in the future.

LTC has defied the broader market trends, registering a whopping $7.213 billion in trading volume over the past 24 hours, surpassing its market capitalization. This unprecedented activity highlights a growing interest in the OG cryptocurrency. Despite its position outside the top 10, LTC is outperforming numerous so-called “shitcoins” with inflated market caps. Many in the crypto community are calling for a market cap readjustment to reflect LTC’s true value and position it among the top three cryptocurrencies.