- Court dismissed a $258 billion lawsuit against Elon Musk and Tesla over alleged Dogecoin price manipulation.

- Allegations were based on Musk’s social media comments, deemed “puffery” rather than actionable fraud.

- The price rose to $0.1008; analysts suggest potential bullish trends based on recent patterns.

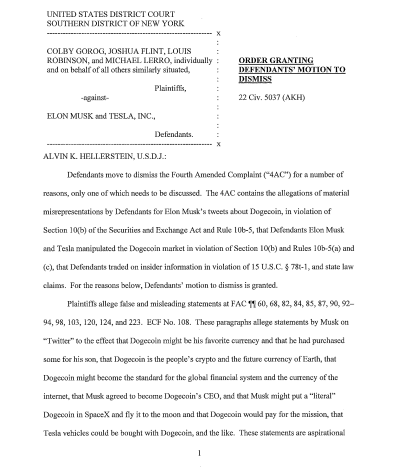

Elon Musk and Tesla recently won a significant legal victory, securing the dismissal of a lawsuit accusing them of manipulating the price of Dogecoin, resulting in $258 billion in damages. The lawsuit, which a group of investors filed, alleged that Musk and Tesla used various tactics, including social media posts, to artificially inflate the value of the meme-based cryptocurrency Dogecoin, only to then sell off their holdings for a profit.

According to the ruling, the court dismissed the Fourth Amended Complaint (4AC) filed by the plaintiffs. The judge highlighted that the allegations were largely based on Musk’s aspirational statements about Dogecoin on social media, including tweets suggesting that Dogecoin might be his favorite currency, calling it “the people’s crypto,” and humorously claiming it could become the global standard for internet transactions.

While colorful and provocative, the court deemed these statements mere “puffery”—a legal term for subjective promotional statements not meant to be taken literally. The court concluded that no reasonable investor would rely on such statements as factual, thereby invalidating the basis for a securities fraud claim under Section 10(b) of the Securities Exchange Act and Rule 10b-5.

Further claims by the plaintiffs, which suggested that Musk and Tesla were involved in a “pump and dump” scheme—a tactic where the price of an asset is inflated through false or misleading statements only to be sold off at a profit—were also dismissed.

The judge noted a lack of concrete evidence supporting the allegations of insider trading or market manipulation. The ruling cited precedent cases that reinforce the need for clear and factual misrepresentations to establish such claims, which were absent in this lawsuit.

As a result of these findings, the court granted the defendant’s motion to dismiss the lawsuit with prejudice, meaning that the plaintiffs were barred from filing another case on the same grounds. The decision effectively ends the legal battle for Musk and Tesla regarding these specific allegations of Dogecoin price manipulation.

Dogecoin Shows Signs of Recovery

Dogecoin, the cryptocurrency at the center of this legal battle, has had a turbulent week has since shown signs of recovery with a slight increase in the last 24 hours, bringing its trading price to $0.1008. Technical analysts are offering mixed predictions about Dogecoin’s future price movements.

Crypto analyst Trader Tardigrade pointed out a possible bullish reversal on the DOGE H4 chart showing a “Diamond Reversal Pattern”. This pattern suggests that Dogecoin is at the end of the current down trend.

Meanwhile, another analyst, dogegod, mentions a pattern where the chart typically leads to a price increase of Dogecoin which, according to the prediction, should take place by September.

Related | Scam Alert: Mbappe’s X Account Hacked: Fraudulent MBAPPE Token Crashes to Zero