- An Ethereum whale, inactive for eight years, has started selling its massive ETH holdings.

- The whale has already dumped $224 million worth of ETH and still holds over $1 billion.

- Whale activity can significantly influence market dynamics, leading to price fluctuations and volatility.

A long-dormant Ethereum whale became active and began liquidating its holdings, raising eyebrows among market watchers. This holder, identified by a blockchain analytics firm, Lookonchain, amassed a significant fortune in 2016. Data showed that this whale accumulated a whopping 398,889 ETH at an average price of approximately $6 per ETH. At the time of acquisition, this stash was worth over $2.4 million. However, today this same stash is valued at $1.34 billion, reflecting the high-risk, high-reward nature of cryptocurrencies.

After remaining inactive for over eight years, the whale reemerged on November 7th and began offloading ETH. To date, the address has sold 73,356 ETH, worth approximately $224 million. Despite these substantial sales, the whale still retains a significant portion of its original holdings, with a balance of 325,533 ETH, currently valued at over $1.1 billion.

The whale’s activity has sparked speculation and intrigue within the crypto community. While the motivations behind these sales remain unclear, there could be various reasons. Some analysts suggest that the whale may be taking advantage of the current market conditions to secure profits, while others speculate that the funds may be required to meet liquidity needs or other financial obligations.

Ethereum Whales’ Market Impact

As the crypto market continues to evolve, the actions of significant holders like this Ethereum whale can have a substantial impact on price movements. The market will be closely watching to see if the whale continues to sell or if it decides to hold onto its remaining ETH.

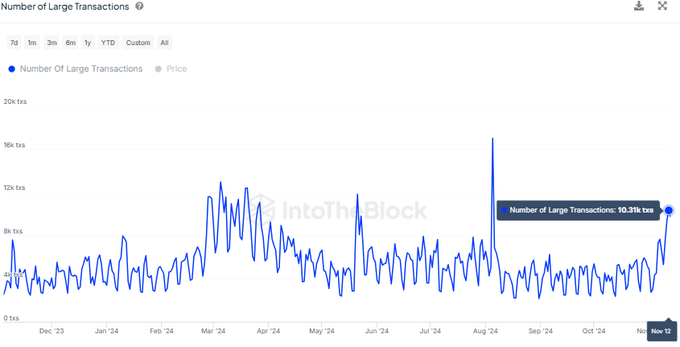

In the broader context, Ethereum whales are staging a comeback and initiating large transactions. As seen in the chart, there has been a noticeable spike in the number of large transactions in November, aligning with the broader market rally. Whale activity is characterized by fewer but larger transactions, and therefore can significantly influence market dynamics and price movements.

While they leave a significant impact on the market, especially when large amounts of ETH are bought or sold. This can also be a precursor of price fluctuations and increased volatility.