- Retail crypto ownership has surged since 2020 despite market volatility and high-profile firm collapses.

- IOSCO emphasizes the need for enhanced investor education to address growing risks and scams in the crypto space.

- Regulatory efforts across jurisdictions continue to intensify, focusing on protecting retail investors and enforcing compliance.

According to a report by the International Organization of Securities Commissions (IOSCO), crypto ownership has grown significantly among retail investors, especially since 2020. This trend comes despite market volatility, fraud risks, and high-profile collapses, such as the failure of FTX in 2022.

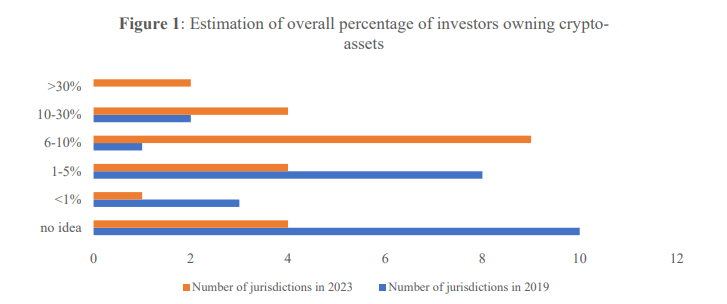

IOSCO’s findings show that interest in crypto remains strong, particularly among younger, predominantly male investors. In 2023, the percentage of retail investors holding digital-assets across 24 jurisdictions ranged from 6% to over 10%, reflecting a marked increase from previous years.

The report highlights ongoing challenges in the crypto market, including volatility, fraud, and hacking risks. IOSCO calls for increased investor education, especially for newer investors, who often lack awareness of these risks. Social media also plays a key role in influencing retail investors, who often rely on friends and online sources for crypto advice.

Regulatory Push Amid Crypto Market Challenges

Despite the enthusiasm, regulatory bodies have made efforts to ensure investor protection. In 2022, the global crypto market experienced a massive downturn, often called the “crypto winter.”

This was fueled by rising interest rates and global inflation, which led to a sell-off of riskier assets, including digital currencies. Bitcoin, for instance, fell sharply from its peak of $67,000 to around $16,000 by the end of 2022. The collapse of firms like FTX and Three Arrows Capital also intensified regulatory scrutiny.

Organizations like IOSCO, the SEC, and the CFTC have increased enforcement, targeting fraud and regulatory violations. The SEC has taken over 160 actions, including against Coinbase and Binance for registration failures. Other countries, like Thailand and Canada, have also initiated efforts to protect retail investors from scams.

Growing Need for Investor Education

The IOSCO report underscores the importance of investor education as a crucial defense against fraud and risky investments. Retail investors, particularly younger and newer participants in the crypto space, often lack the knowledge needed to navigate the market’s complexities.

The fear of missing out (FOMO), combined with the influence of social media and friends, has led many to invest without fully understanding the risks involved.

Regulatory bodies are responding by launching public education campaigns to raise awareness about the potential dangers. With the crypto market’s volatility showing no signs of abating, these initiatives are seen as essential to protecting retail investors and maintaining market integrity.

Related Reading | Is Ethereum Ready for a Major Rally? Key Insights on Ethereum’s Future