- Solana’s daily DEX volume has consistently exceeded $5 billion, highlighting the network’s growing dominance in decentralized finance.

- The Syncracy Capital report sees Solana’s valuation as undervalued, with a significant potential to rival Ethereum.

- Solana’s unique network advantages and applications suggest an upward trajectory for its blockchain and native token, SOL.

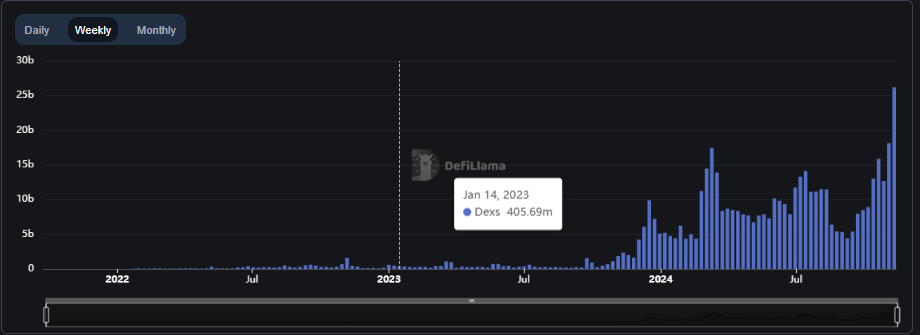

Solana’s decentralized exchanges (DEXs) reached a new peak, crossing $5 billion in daily trading volume for three days straight, a first for the blockchain. Throughout the week from November 10 to 16, the total trading volume amassed a substantial $15.9 billion, per DeFiLlama data. Raydium, one of the network’s key DEX platforms, was a major driver, responsible for nearly 60% of this trading activity.

This remarkable surge in trading volume highlights the network’s growing adoption and signals the platform’s increasing appeal as a decentralized finance (DeFi) powerhouse. The blockchain’s speed and low fees have made it a preferred choice for retail trading, even as it has a broader impact across emerging sectors like decentralized physical infrastructure networks (DePIN) and on-chain payments.

Solana’s Valuation Draws Attention from Syncracy Capital

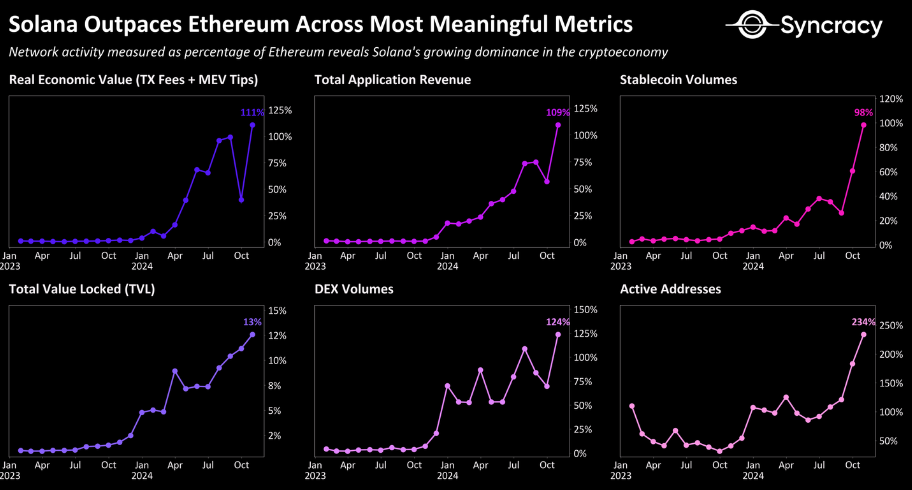

Syncracy Capital recently released a report on Solana, presenting a compelling case for SOL’s value. According to the report, the network’s 2023 valuation was misaligned, trading at just 13% of Ethereum’s market cap despite its scalability, high transaction speeds, and developer engagement. With Solana now trading at roughly 33% of Ethereum’s valuation, Syncracy argues that the broader market may still underestimate its full potential.

Since the collapse of FTX, which had initially cast a shadow over Solana, the blockchain has regained momentum. This resurgence has been bolstered by broader industry developments, including the launch of the Bitcoin ETF, which collectively fostered growth across the blockchain’s ecosystem. As adoption rises, the network is emerging as a serious competitor to Ethereum, especially in economic indicators like trading activity and application revenue.

Solana’s Network Effects Signal Strong Growth

According to Syncracy, beyond its technical strengths, Solana’s ecosystem is expanding through network effects. As the blockchain attracts more developers, applications, and businesses, it’s becoming a foundational pillar in the crypto economy. Unlike Ethereum, the network’s growth has been fueled by rapid innovation and a “move fast” approach, which has driven adoption and accelerated product rollouts.

With notable applications like Pumpdotfun and several non-financial sectors driving usage, the network proves that its low-cost, high-speed infrastructure supports new levels of blockchain interaction. As these effects compound, Syncracy anticipates that it could establish itself as a leader in DeFi and beyond, potentially rivalling Ethereum’s influence.

Related Reading | Dogecoin Eyes $1–$3 Amid Historic Market Gains and Bitcoin’s Lead