- Solana (SOL) Price rebounds to $141.07 from a low of $112.

- SOL’s rise follows Bitcoin’s surge, highlighting market interconnections.

- Analysts suggest potential scenarios include a 30-50% rise or a longer-term bullish trend, with a crucial Fibonacci level at $103.

Solana (SOL) is making waves with its remarkable recovery. It indicates immense strength after hitting a recent low of $112. This cryptocurrency, which had been struggling earlier in a bearish market, is rising again due to the sudden shift in market sentiments

The turnaround began when Bitcoin’s recent surge sparked a broader bullish phase across the cryptocurrency market. Gaining momentum, Bitcoin paved the way for altcoins like SOL to resurge in price action, with SOL spearheading the charge.

As of today, the price of SOL is $141.07. The cryptocurrency has recorded an enormous rise in trading activity, where its trading volume over 24 hours reached $28.01 billion. This upside in trading volume indicates increased interest of investors in the prospects of SOL. The market capitalization for SOL reached $63.40 billion, giving it a dominance of 3.21% in the market.

In the last 24 hours, Solana’s price surged by 12.05%, making for a strong bounce back from its recent low. This impressive gain shows that Solana is resilient and that the crypto market has a bullish sentiment behind it.

Solana’s Price May Rise 30-50% or See Long-Term Bullish Trend

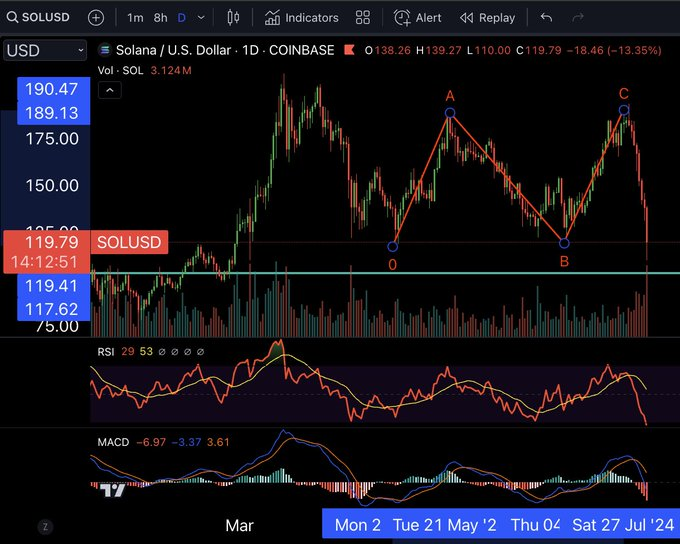

Ali Martinez, a well-known cryptocurrency analyst, has pointed out a promising technical pattern forming on Solana’s lower time frames. According to Martinez, SOL seems to be creating a “W” pattern, a chart formation often indicative of a potential bullish reversal.

Martinez suggests that if Solana manages to sustain a closing price above $125, it could pave the way for a rally up to approximately $142. To manage risk, Martinez has set a stop-loss level at $117, indicating a cautious but hopeful outlook on Solana’s short-term performance.

Moreover, analyst Sajad has also shared his outlook on SOL. Sajad noticed that the 1:1 Fibonacci retracement level is sitting around $103. He mentioned that this level would be kept a close eye on, as the price might further drop over the upcoming 24 hours. The current technical indicators are very similar to what was seen back in June 2023, indicating that the chances of a large price action are fairly high.

According to Sajad’s analysis, there could be two scenarios for the price trajectory of Solana. In the worst case, that would mean a “dead cat bounce”; the price will briefly increase by 30-50% before falling back down again. On the other hand, Solana might, in the best-case scenario, be teed up for a full-on new leg up, which suggests a longer-term bullish trend.

Related | Bitcoin (BTC) Forms Bullish Pattern with $87K Target Amidst Current Decline