- Solana (SOL) hit a new all-time high of $263 on November 22, 2024, and has surged 160% in 2024.

- The price increase is fueled by filings for spot Solana ETFs and growing investor interest.

- Experts predict an 84% potential surge to $457.97 if support above $233.8 holds.

Solana (SOL) has been making waves in the cryptocurrency market, hitting a new all-time high (ATH) of $263 on November 22, 2024. This milestone comes just two years after the collapse of the FTX exchange, which significantly impacted SOL’s price at the time. Despite experiencing a brief pullback following the ATH, SOL remains resilient and shows strong potential for further gains.

Since the start of 2024, Solana has been one of the top-performing altcoins. Its price took a significant hit in December 2022, when FTX, once one of the largest crypto exchanges, fell apart, dragging down the price of many cryptocurrencies, including SOL. At that point, SOL had dropped to a cycle low of just under $10, leaving many wondering about the future of the blockchain and its native token.

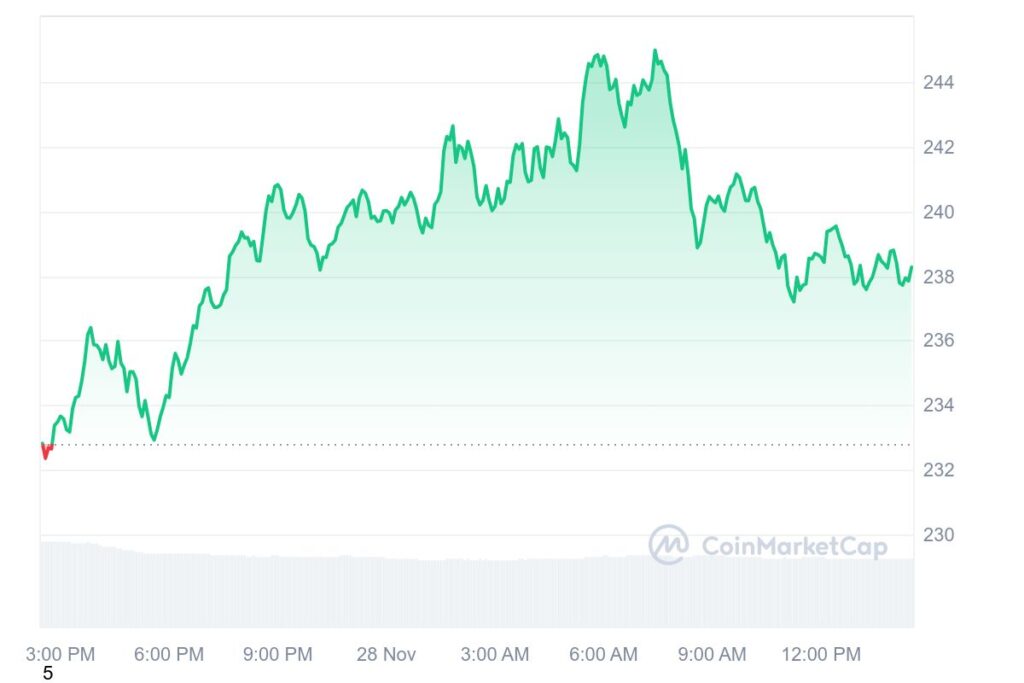

As of now, SOL is trading at $238.06, with a market capitalization of $113 billion and a market dominance of 3.38%. The cryptocurrency has been gaining momentum in recent weeks, driven by several key events. Over the past 24 hours, SOL’s price increased by 2.78%, signaling ongoing investor interest.

Solana Surge Fueled by Spot ETF Filings

The surge has been partially fueled by filings from major asset managers, including Bitwise, VanEck, 21Shares, and Canary Capital, all of whom are seeking approval for spot Solana exchange-traded funds (ETFs).

On November 21, the Cboe BZX Exchange submitted four 19b-4 filings to list spot Solana ETFs, which, if approved, would be a major development for the crypto space. These filings came on the same day that the U.S. Securities and Exchange Commission (SEC) confirmed that its chairman, Gary Gensler, would step down in January, leading to further speculation about the future regulatory landscape for cryptocurrencies.

If the ETFs are approved, Solana’s exposure to traditional investors could increase significantly, fueling its already impressive performance. The demand for SOL has also been driven by a surge in memecoin speculation, as Solana’s blockchain provides a cost-effective and efficient platform for minting these tokens.

Solana Poised for 84% Surge, Bulls Eye $457.97

Looking ahead, some market participants believe that SOL’s price could continue to rise. Javon Marks, a crypto expert, recently shared his bullish outlook, noting that SOL has shown strong support above the $233.8 mark. If this level holds, Marks predicts that SOL could reach a target of $457.97, representing a potential 84% increase from its current price.

The momentum behind SOL is undeniable, and as the blockchain continues to attract attention from both institutional and retail investors, it seems poised for further upside. With major developments like the potential approval of Solana ETFs and growing interest from memecoin enthusiasts, Solana’s future looks bright as it rides the wave of its impressive 2024 performance.

Related | Bitcoin (BTC) ATH Sets Stage for $113K, On-Chain Data Supports