- Multicoin Capital proposes a variable-rate inflation model to optimize Solana token economy.

- The plan balances inflation reduction with sustainable staking yields and ecosystem growth.

- Community discussions and validator feedback shaped the proposal’s parameters.

Multicoin Capital announced a proposal for Solana to transition into a variable-rate inflation system regarding its token emission model; this will help decrease inflation while supporting staking dynamics and long-term ecosystem sustainability.

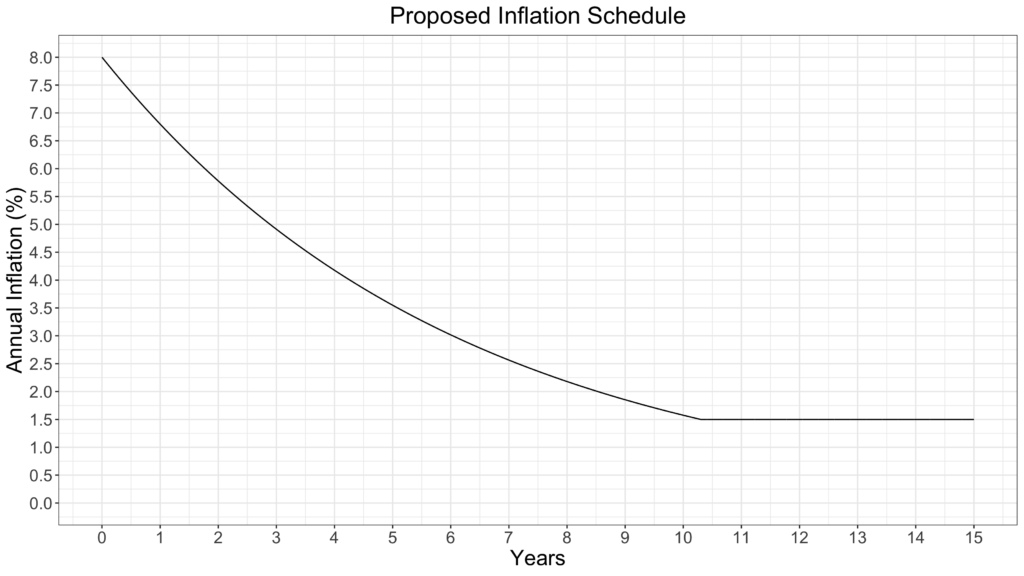

Currently, Solana operates on a fixed schedule of inflation. The proposed model provides for three parameters: Initial Inflation Rate of 8%, Disinflation Rate of -15%, and Long-term Inflation Rate of 1.5%. The proposed adjustments make for balanced token issuance, reasonable staking yields, and validator support.

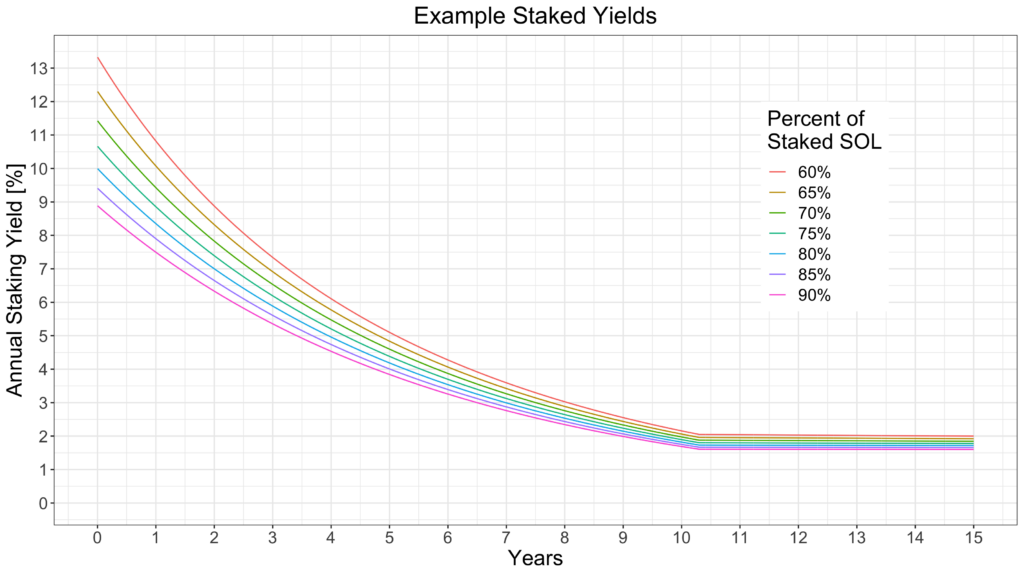

According to Multicoin, staking yields are primarily driven by the percentage of SOL staked relative to the total supply. Validators and delegators would receive rewards proportional to their staked amounts, with validators earning additional commissions. The model’s focus is on promoting network participation while mitigating token dilution over time.

Proposal’s Focus on Solana Long-Term Health

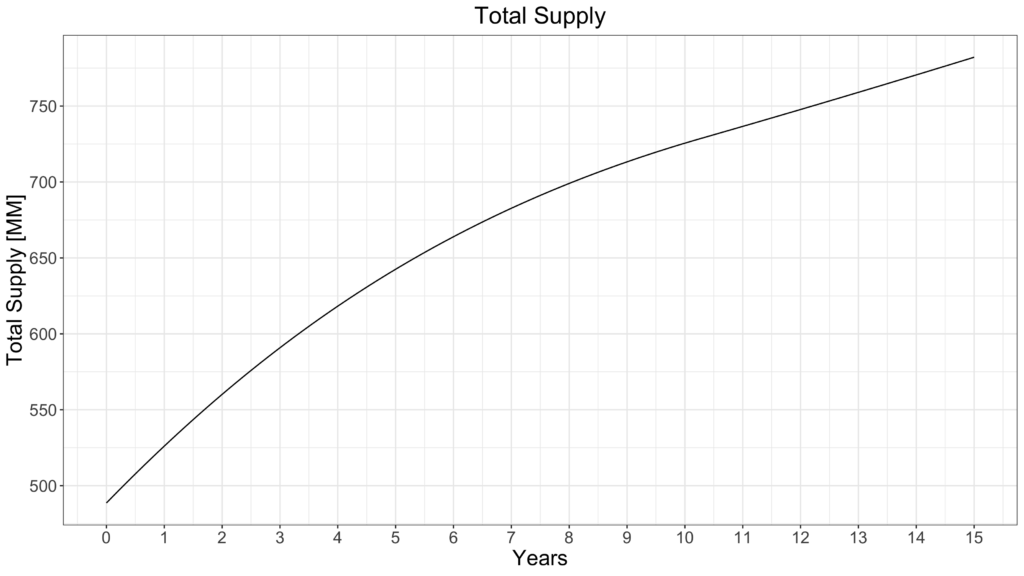

The proposal focuses on the long-term health of the Solana ecosystem. Gradual deflation lets the network ensure that the issuance of the token is controlled as it aligns with the projected growth in usage. Multicoin aspires to a balance between validator incentives and accounting for token burns, losses, and growth in transaction volume.

The proposed inflation schedule puts a hard cap on the SOL issuance, excluding variables such as fee-burning and slashing events. The proposal contains graphs of the annual inflation decrease and its estimated growth over time in total supply. This is a clear graph that explains the gradual reduction in inflation to sustain economic balance across the network.

Community feedback has been really instrumental in shaping this proposal. Investors and validators have underscored that competitive staking yields must be devoid of highly excessive inflation. Due to the dynamic nature of staking participation, the model considers a range of staking percentages from 60% to 90% and reflects realistic network conditions.

Community Engagement Shapes Future Adoption

Multicoin Capital’s proposal addresses the adjusted staking yields, considering token dilution and staking incentives. Conceived on the assumption of dynamic participation rates, it provides consistent rewards to validators, ensuring network security and efficiency.

This adjustment, if applied, would also further Solana’s vision for an advanced, sustainable validator ecosystem, incentivizing the use of the network. The community, though, would need to vote and will ultimately decide the outcome of this proposal.

In that direction, if it pass, this variable-rate inflation model might go on to redefine how staking rewards and inflation mechanisms are set for Solana-likely making it one of the robust Proof-of-Stake networks out there.

Multicoin’s proposal would position Solana as a leader in the innovation of staking by better aligning inflation schedules with network growth and usage. When sustained growth and participation of the network are combined with controlled token issuance and improved staking dynamics, sustained growth and participation of the network may be realized. The transformative plan now goes up for review before the Solana community.

Related Reading : Why Ethereum Enthusiasts See ETH as the Key to AI’s Evolution