- Solana’s price has been highly volatile due to stagnant stablecoin liquidity.

- Recent stablecoin inflows to Solana could stabilize prices and attract investors.

- Brazil approves first SOL spot ETF, opening new investment avenues.

Solana’s price has exhibited sharp fluctuations throughout 2024. These dramatic price spikes and crashes are mostly attributed to stagnant stablecoin liquidity since April 2024. However, recent data suggests potential shifts in this trend.

Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar and are used for trading and hedging against price fluctuations. Here stagnant liquidity indicates that the amount of stablecoins available for trading on Solana has not risen significantly since April. With limited stablecoins, it’s harder to stabilize SOL’s price, leading to the observed volatility.

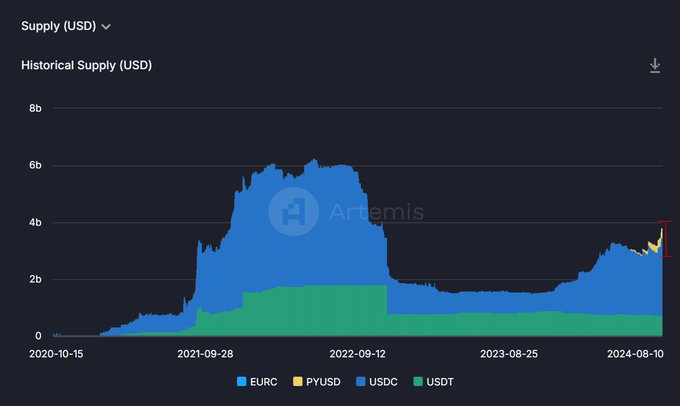

The chart above illustrates the historical supply of stablecoins (USD) on Solana, including EURC, PYUSD, USDC, and USDT. Except from 2021 to 2022, stablecoins supply has largely been stagnant. This slowdown in the metric has led to rapid swings in SOL’s price movement as market participants struggled to find stable assets for trading and hedging.

However, market experts have spotted signs of renewed interest in Solana’s stablecoin ecosystem from April 2024 onwards. Inflows of USDC and PYUSD have been observed this month, indicating a potential uptick in stablecoin liquidity. If this trend persists, it could have a stabilizing effect on SOL’s price and attract more institutional investors seeking exposure to the SOL ecosystem.

While the recent inflows are promising, it’s essential to monitor these developments closely. A sustained increase in stablecoin liquidity is crucial for SOL to mature as a viable platform for decentralized finance (DeFi) and other applications.

First Solana ETF

If Solana can successfully address the liquidity challenges and foster a thriving stablecoin ecosystem, it could position itself as a strong competitor in the broader cryptocurrency landscape.

In a related development, the first-ever Solana spot ETF received the green light in Brazil. The Brazilian Securities and Exchange Commission [CVM] has approved the spot ETF. This groundbreaking development was a significant step forward as the ETF, provided by QR—a prominent player known for its Bitcoin and Ethereum ETFs—will be managed by Vortx. At present, the ETF awaits final approval from B3, Brazil’s main stock exchange, It is expected to hit the market within 90 days.