- Thailand SEC proposes new rules allowing funds to invest in digital assets, aligning with global trends.

- Public comments on the proposed regulations are open until November 8, with final rules expected in 2025.

- Retail mutual funds face a 15% crypto exposure cap, while institutional funds have no limits but must diversify.

In a crucial development, the Thailand Securities and Exchange Commission (SEC) has outlined new regulations to allow mutual and private funds to invest in digital assets. This move is in line with the global trends and caters to increasing institutional demand for cryptocurrency investment opportunities.

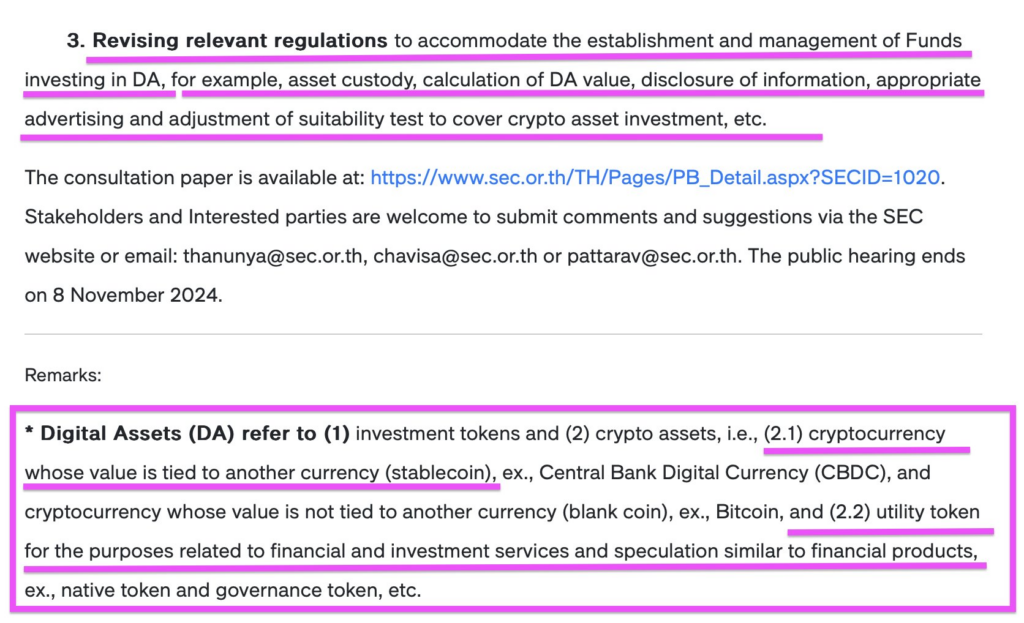

As per the official document, Thailand’s regulator is aiming to overhaul its legacy financial regulations, proposing new rules to allow mutual and private funds to invest in digital assets like Bitcoin and Ethereum. A draft proposal published on 9th Oct seeks public feedback on the revisions, that would allow securities companies and asset management firms to offer services to large investors interested in crypto-related products, including exchange-traded funds (ETFs).

The SEC’s initiative comes amid rising interest in cryptocurrency investments, spurred by the success of U.S.-listed Bitcoin and Ethereum ETFs launched earlier this year. Although Thai investors already have access to such ETFs through foreign markets, the current mutual fund framework in Thailand, established in 2015, has not been updated with the rapid developments in digital asset investing.

Thailand’s SEC Proposes Stricter Rules for Bitcoin and Other High-Risk Crypto

Delving deeper, the regulator’s proposal emphasized on making a clear distinction between high-risk assets, such as Bitcoin, and more stable digital assets like Tether, a stablecoin whose value is designed to maintain consistency amidst market volatility. It also highlights the importance of fiduciary duty for fund managers, who are tasked with managing associated risks and ensuring appropriate investment strategies.

If approved, the proposed regulations would impose a 15% cap on digital asset exposure for retail mutual funds, while institutional and ultra-high-net-worth investor funds face no exposure limits. However, these funds must maintain diversification to manage risk effectively. Additionally, the draft suggests limiting the holding period for assets like Bitcoin or Ethereum to five business days for trading purposes.

Public feedback on the proposal is being accepted until November 8, with final regulations expected to be implemented next year. Overall, Thailand’s SEC is stepping into the digital age with new regulations allowing mutual and private funds to invest in cryptocurrencies, catering to growing institutional demand while addressing risk management. The final rules are anticipated by next year