- USDC has set a new record, surpassing $16 trillion in total transaction volume, solidifying its position as a leading stablecoin.

- Circle’s adherence to European regulations, unlike Tether’s criticism, has earned trust and increased USDC’s market share.

- The stablecoin has become the dominant stablecoin on the Solana blockchain, accounting for over 65% of the total supply.

Circle’s USDC, a leading dollar-pegged stablecoin, has achieved a significant milestone, surpassing a total transaction volume of $16 trillion. This achievement underscores the token’s growing popularity and acceptance within the cryptocurrency ecosystem.

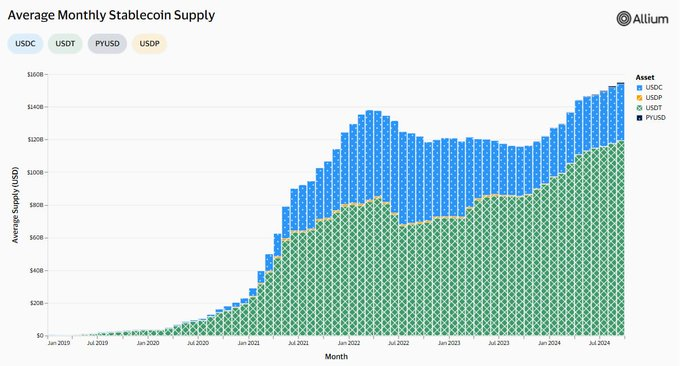

Launched in 2018, USDC has steadily gained traction, amassing a circulating supply of approximately $34.6 billion. While it currently ranks second in terms of market capitalization behind Tether (USDT), USDC has recently made significant strides due to favorable regulatory developments in Europe.

Under the Markets in Crypto-Assets (MiCA) regulations, USDC has emerged as a preferred choice for stablecoin transactions in Europe. This is in sharp contrast to Tether whose CEO Paolo Ardoino sees the European Union’s just-implemented Markets in Crypto-Assets (MiCA) regulation as a huge threat to stablecoin and system-wide financial stability. As reported earlier, Ardoino slammed MiCA for having potential increases in systemic risks rather than decreasing them.

Circle, on the other hand, has maintained a neutral stance while adhering to these stringent regulations which has fostered trust among investors and businesses, contributing to its market share growth. As a result, the stablecoin now accounts for approximately 50% of all stablecoin transactions in Europe, surpassing USDT despite having a smaller overall supply.

USDC On Blockchain Networks

Beyond Europe, USDC has also demonstrated strong performance on alternative blockchain networks. The Solana blockchain, in particular, has seen a surge in the stablecoin adoption. Approximately 65% of Solana’s stablecoin supply is composed of USDC, and its transaction volume on Solana has reached a staggering $8.29 trillion, outpacing USDT’s volume on the Tron chain.

Looking ahead, the leading stablecoin’s continued expansion is likely to be closely tied to the growth and adoption of alternative blockchain networks. As Ethereum’s stablecoin market matures, chains like Solana and Tron could play a more pivotal role in facilitating stablecoin transactions. The token’s ability to adapt to these evolving trends will be crucial to its long-term success.

Overall, USDC’s achievement of a $16 trillion transaction volume underscores its growing popularity, regulatory compliance, and strong performance on various blockchain networks. As the stablecoin market continues to evolve, its position as a leading player is poised to strengthen further.