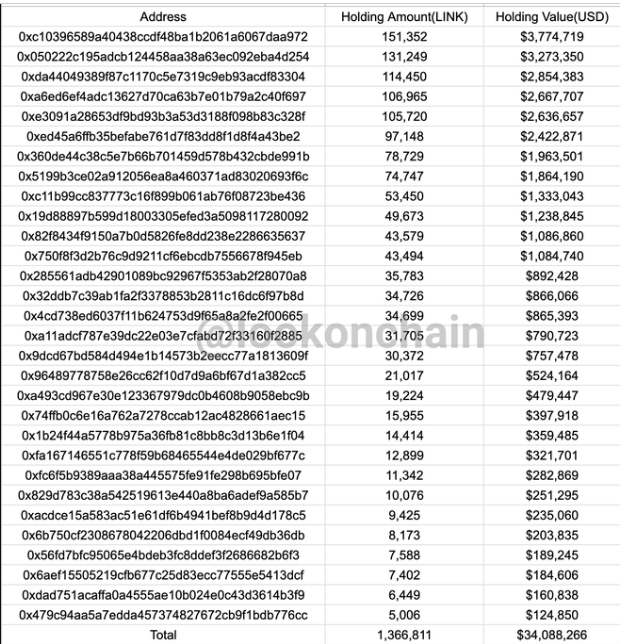

- A whale investor spent $34.1 million on 50 billion won in Chainlink tokens, creating 30 new wallets.

- LINK launched Smart Value Recapture (SVR), boosting DeFi with auction-based revenue-sharing from Oracle’s price feeds.

- Chainlink’s price is up 34% over the past month, testing $26.14 resistance, with support at $22.04.

Chainlink (LINK) has introduced a new decentralized finance (DeFi) solution, while a whale investor seems to be buying up Chainlink tokens. On December 25th, The Daily Hodl reported, citing Lookonchain data, that a whale investor created 30 new wallets to acquire Chainlink tokens worth $34.1 million (around 50 billion won) from Binance by creating 30 new wallets.

On December 23rd, Chainlink announced the debut of Smart Value Recapture (SVR), a feature that allows the sale of revenue-generating rights from LINK Oracle’s price feeds through a MEV (Maximum Extractable Value)-share auction, channeling the proceeds back to DeFi users.

On-chain data paints a mixed picture for Chainlink’s broader ecosystem. Over the past week, the number of active wallets and new addresses fell by over 20%. Zero-balance addresses also decreased by nearly 32%, signaling a decline in retail investor activity. However, the recent whale movements suggest that large holders remain optimistic about LINK’s long-term prospects.

Chainlink Price Analysis and Whale Activity Reflect Market Sentiment

At the time of writing, Chainlink is trading at $24.04, reflecting a 34% increase over the last month. Despite this positive price action, LINK is currently battling a critical resistance level at $26.14. Traders are watching closely to see if it can break this resistance, which could trigger a price surge toward $30 and beyond. Support levels are also evident at $22.04, giving buyers a base to build on.

The technical indicators tell a story of mixed sentiment. The MACD suggests bearish momentum, while the ADX reading of 28.99 indicates strengthening trend dynamics. Buyers have been accumulating LINK near the $22.04 support, which hints at potential bullish moves if the buying pressure increases. If LINK surmounts the $26.14 resistance, it may ignite a rally, offering an attractive opportunity for investors.

LINK’s SVR initiative aligns with the interest in DeFi solutions, positioning LINK as a key player. Aave, the leading lending platform, recently proposed using SVR to recapture MEV from its liquidations, marking a notable endorsement of Chainlink’s new solution. The proposal is currently under review by the Aave community, indicating that LINK’s SVR could soon gain traction in the DeFi space.

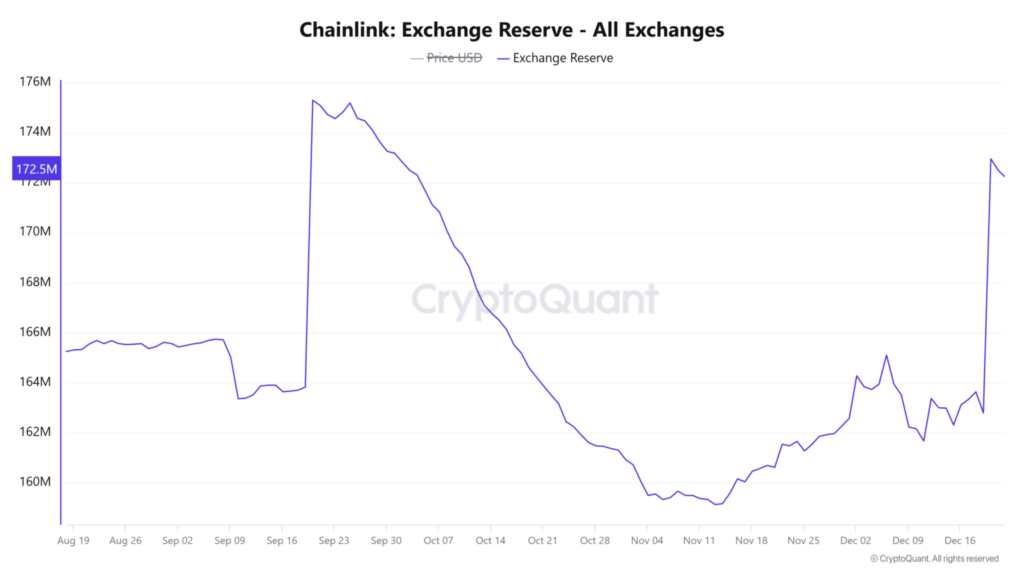

Along with the surge in whale accumulation, LINK has seen a notable increase in transaction volume. Daily LINK transactions grew by 1.05%, surpassing 11,466 transfers, according to CryptoQuant analytics. The surge in activity reflects increasing interest in LINK, likely driven by recent developments such as the launch of SVR. LINK’s exchange reserves have also slightly decreased by 0.06%, reflecting reduced sell-side liquidity.

Read More: Chainlink’s Price Dips to $20, But Bullish Reversal Could Push LINK to $52