- XRP holders are gearing up for the upcoming XFF airdrop on November 10th. To maximize rewards, holders are encouraged to increase their XRP holdings.

- The newly launched XFF token has seen significant early success, with nearly 5% of the circulating supply already locked in lending pools.

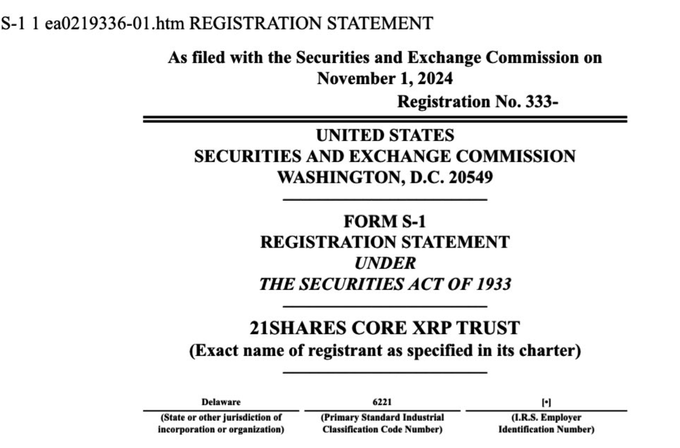

- 21Shares has filed for a spot XRP ETF, potentially increasing investor access to XRP in the US.

XRP holders are abuzz with the upcoming launch of XFF, a new token powered by the XRP Ledger. The highly anticipated airdrop for XFF tokens is scheduled for November 10, 2024. To attract users, the project has devised an ingenious plan to maximize rewards. The holders are encouraged to check their tier on the official link and increase their holdings of the token before the news and the first game launch.

As per the announcement post, XFF promises to revolutionize the gaming industry by leveraging the power of the XRP Ledger. This innovative token will offer a seamless and secure gaming experience, attracting a wide range of gamers and developers. With its robust foundation and exciting potential, XFF is set to make a significant impact on the gaming market.

The upcoming airdrop is a major milestone for the XFF project, marking the beginning of a new era in gaming. By rewarding holders, the project aims to foster a strong and engaged community. As the launch date approaches, excitement is building among XRP holders, who are eagerly anticipating the benefits that XFF will bring.

XRP Consolidates Above $0.50, XFF Sees Strong Demand

Following the announcement, the Ripple-affiliated token continues to show resilience, with $0.50 serving as a strong support level. On the other hand, the newly launched XFF token has already gained rapid traction. In just one day, nearly 5% of the circulating XFF supply has been locked in lending pools, demonstrating strong community interest and potential for future growth.

With the XFF presale coming to an end, investors have a limited window of opportunity to participate in this exciting project.

Alongside this development, the community is excited about recent ETF listings. On November 1, 21Shares filed an S-1 registration application with the Securities and Exchanges Commission for a spot ETF. If the regulator greenlights the filing, the firm will establish its 21Shares Core XRP Trust, listed on the Cboe BZX Exchange, and Coinbase Custody Trust Company, its custodian.

Speaking on the filing, a spokesperson at the company commented:

21Shares remains committed to working towards expanding US investor access to the cryptocurrency asset class, and we look forward to driving innovation in the US.