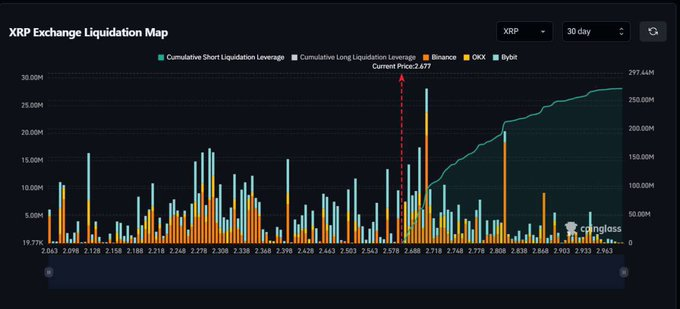

- $272.3 million worth of XRP short positions are at risk of liquidation if the price reaches $3.

- This has fueled speculation about a potential short squeeze.

- XRP’s price action is being closely monitored as the market anticipates a potential breakout.

The XRP market is heating up as a potential short-squeeze scenario emerges. Data from Coinglass states that a whopping $272.3 million worth of XRP short positions face liquidation risks if the altcoin breaches the $3 mark. This significant exposure to short positions could lead to a potential short squeeze and a chain reaction of liquidations could follow, driving the price even higher.

Currently trading at around $2.47, the $3 mark represents a significant psychological and technical resistance level for the token. If it manages to break through this level, it could trigger a cascade of liquidations, forcing short sellers to cover their positions by buying XRP to limit their losses. This buying pressure could propel the price higher.

When traders short a cryptocurrency, they essentially borrow it and sell it, expecting the price to fall. If the price rises instead, they are forced to buy back the borrowed asset at a higher price to limit their losses. This is called a “short squeeze.”

However, it’s important to note that a short squeeze is not always guaranteed. Several factors could influence the outcome, including the overall market sentiment, the strength of buying pressure, and the response of market makers. Additionally, the $3 level could act as a massive resistance, potentially capping XRP’s upside potential.

XRP’s Social Sentiment Remains Upbeat

That said, XRP’s social dominance has reached 5.65% during the broader market slump, showing increased community interest and activity. According to LunarCrush, the token saw an impressive price surge of over 320% in the last three months, reaching a market cap of $128.53 billion. While this growth is encouraging, analysts recommend restraint.

The token’s impressive price surge sparked discussions on platforms like Twitter, where market commentators are highlighting both opportunities and risks. One analyst said retail investors often trigger price spikes but are equally quick to sell off during profit-taking phases. This highlights the importance of strategic profit-taking in such volatile conditions.

Despite these uncertainties, the looming threat of a short squeeze has injected a dose of excitement. Traders and investors are closely monitoring XRP’s price action, anticipating a potential breakout that could unleash a wave of buying pressure and propel XRP to new heights