- Bitcoin (BTC) often transitions from bullish to bearish when its MVRV ratio drops below the one-year SMA.

- BTC recently fell below $61,500, indicating potential losses for investors and possible increased selling.

- Analysts forecast a potential rise to $99,000-$100,000 if BTC breaks out of a ‘descending broadening wedge’ pattern.

Bitcoin (BTC) has recently shown signs of bearish behavior and faced notable volatility. Despite these short-term problems, analysts are still very optimistic about Bitcoin’s prospects in the future, forecasting a possible bullish breakout of this cryptocurrency. In the last seven days, BTC dropped by 2.49%, while for the last 30 days, its price fell approximately by 9%.

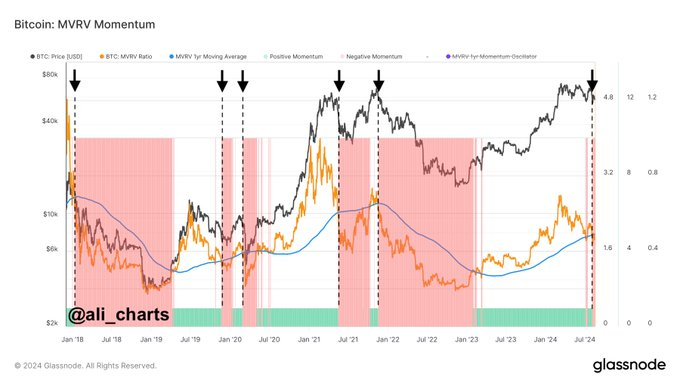

Bitcoin (BTC) continues to be in the limelight across market discussions. Not long ago, a top cryptocurrency analyst, Ali Martinez, described a crucial phenomenon that occurs in the market. According to Martinez, BTC frequently goes from a bullish to a bearish cycle after the Market Value to Realized Value (MVRV) ratio falls below the one-year Simple Moving Average (SMA).

This trend suggests that when the MVRV drops, a large amount of BTC bought at higher prices is now in loss, which could be fueling more distribution and selling pressure in the market. This shift in cycles was apparent when Bitcoin’s price fell below $61,500.

As of now, BTC is trading at $59,115, with a 24-hour trading volume of $102.10 billion and a market cap of $1.17 trillion with a market dominance of 56.12%. On the other hand, BTC has increased by 1.83% in price over the last 24 hours.

Bitcoin Predicted to Hit $100k Despite Bearish Signals

Despite these bearish signals, analyst Javon Marks remains optimistic about Bitcoin’s potential. Marks pointed out that BTC has shown strong strength by retesting the support of a ‘descending broadening wedge’ pattern.

This technical set up often precedes a bullish breakout. According to Marks, if BTC breaks out bullishly from this pattern, it could be targeting a price range of $99,000 to $100,000. Positive signals are coming that indicate Bitcoin may be due for a major move to the upside.

As the cryptocurrency market is still unfolding, it’s important to track such indicators closely for investors/traders. It will be important to note how bearish transitions and a possible bullish breakout interact in order to decipher Bitcoin’s price action in the near future.

Related | IMF’s $0.047 Tax on Crypto Mining: A New Strategy to Curb Emissions